Valuing Your Idea

- Trent Kitsch

- May 3

- 3 min read

Updated: May 13

Building something—whether it’s a business, a vision, or a personal goal—requires direction, conviction, and the ability to see value where others might not. This week, we’re talking about how to measure that value, whether it’s in a company, an idea, or your own future.

So - How do you value a business? How do you value an idea?

Whether you’re raising money, or simply trying to figure out if you should go “all in” on an idea here are three methods to valuing a business:

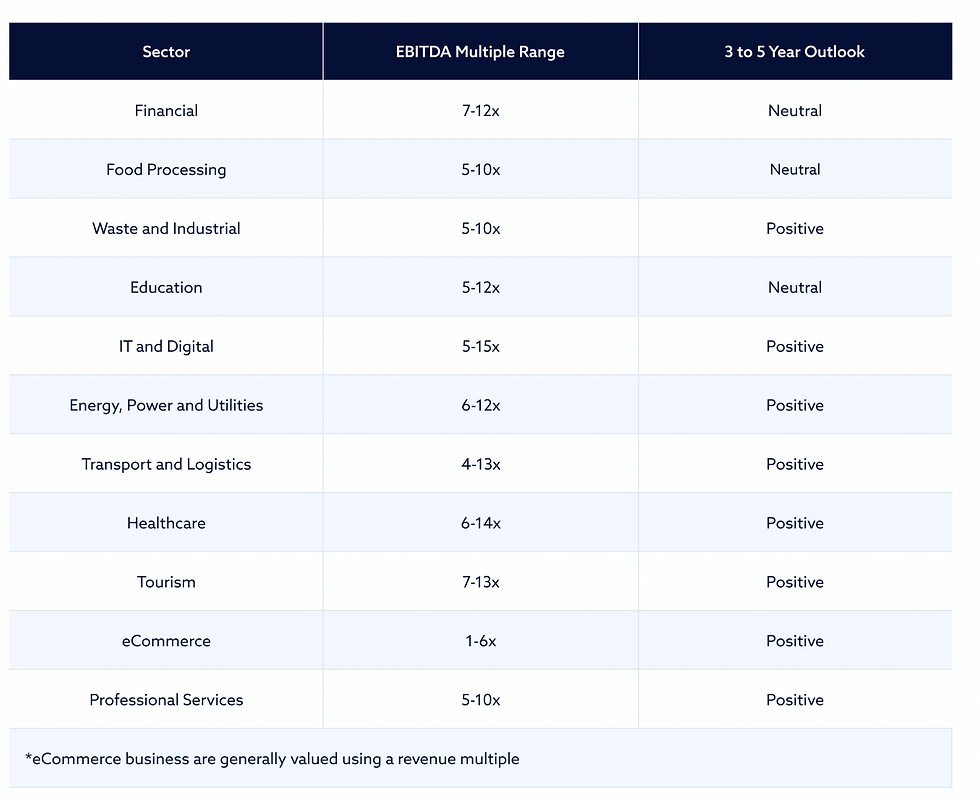

A = The traditional sales/EBITDA (earnings before interest, tax, depreciation, amortization) multiplied by the industry multiples for an industry

B = Market comparables from public or private sales

C = The old “what is someone willing to pay”

Those are three I was taught in business school, and from there you can triangulate the approximate value. So if

A = 20 Million

B = 15 Million

C = 10 Million

Then we know the business is approximately worth in between 10-20 million and now we can use subset factors to get more precise.

The next questions are: What stage is the company in? What is the growth of the industry? What is the management’s track record?

Let’s say you’re raising money without a management track record, you’re a first time founder. This is where you have to paint the picture on your income statement and balance sheet.

TIP: when presenting to investors, starting out saying your valuation is “50 million” and then explaining “why” isn’t going to work. Explaining the value beforehand and then the valuation number will come up because it makes sense, without that initial “woah” reaction will go a long way while raising.

Instead: “Go to page 6, our revenues are X in a industry with a multiple of Y, with a discount rate of 80%, you’ll be investing at a 40 million dollar valuation and in 3 years it’ll be 50” If you’re a great entrepreneur, you’ll project out 3-5 years to paint a picture of value to investors.

Investors aren’t getting it at the price today, they’re getting a discount from the price tomorrow.

Income statements are one thing, but understanding your balance sheet is also crucial as the sophistication of the investor goes up (Family & friends, private, institutional, etc). After the investment and growth what assets will you have, how will this affect the stability of the company.

When planning what investment you want to take on there are a few considerations.

What are you willing to invest? (NOT what are you willing to risk, because you’ll probably lose it all if that’s the mindset).

Plan out future rounds. When is the breakeven point and how many rounds do you want to finance? How many do you need to finance to get where you’re going. Where do you need to be for Series A, B, etc. Make a model, have a conservative, and worst case scenario (because entrepreneurs are usually quite optimistic).

It usually takes twice as long and twice as much money when starting a business.

Remember if you’re selling 20% of the business at each round your shares are going to dilute.

Final notes on valuing a business, and more specifically valuing an idea:

Get a lot of independent views (not friends or family).

Gauge interest by the type of conversations you’re having and if you’re having conversations at all. If someone is willing to give you their time they’re usually somewhat interested. Are people asking buying questions or “F-off” questions. Can you steer the conversation to buying questions?

Enjoy this clip from the Boiler Room where he talks about exactly what I’m saying ⤵️

Once you have interest you have to create urgency. Fundraising is like baking a cake, you need the ingredients and then you need time pressure.

Final tip: a lead investor is key. Once other people know you have someone who has “set the market” or has bought in the rest of the round becomes incredibly easier to fill.

Comments